WHAT MAKES FAIRWAY & RACHELI MORTGAGE TEAM DIFFERENT?

Racheli Refael has helped homebuyers for over 26 years get pre-approved* for a home mortgage so they know exactly what their budget is from the get-go.

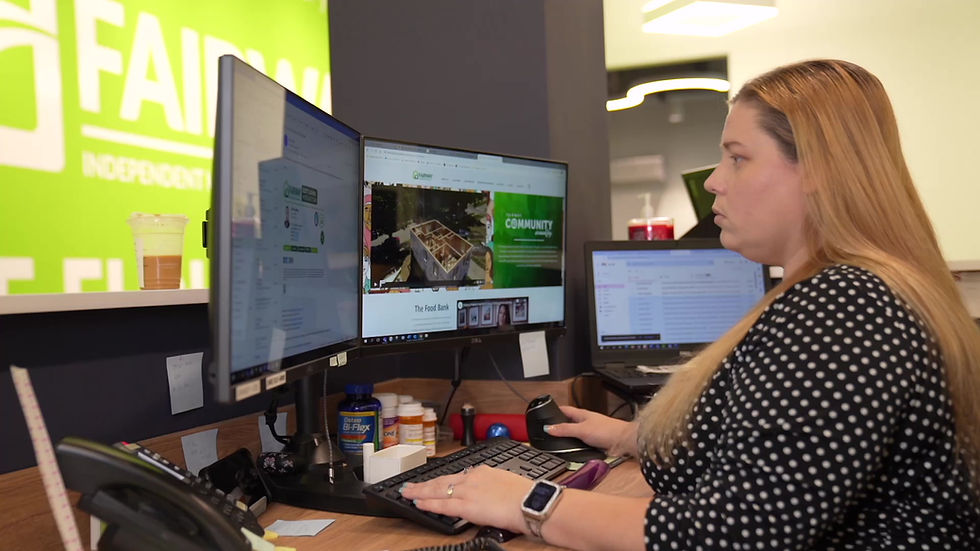

Her committed team of five service-oriented, & dynamic individuals is ready to meet your needs and exceed your expectations in our friendly and centrally located office in east Fort Lauderdale. Racheli Mortgage Team believes in finding creative solutions so that people feel empowered to overcome obstacles, see possibilities, and take immediate action.

By taking the birds-eye-view approach, which she learned in the Israeli army, she can see solutions where other may not. That's why 98% of her team pre-approvals close.

When you want to buy a home with a mortgage and don't know where to start, or if you even qualify? Reach out to Racheli Mortgage Team who helped thousands of home buyers by creating an easy and simple roadmap to homeownership.

I WILL BE HERE FOR YOU FROM START TO CLOSE.

AN ALL-STAR PROCESSING & SUPPORT TEAM

FREE MORTGAGE RESOURCES

Please Subscribe to My Channel on YouTube. I am always sharing FREE RESOURCES for you to learn about the Mortgage Industry, How to Get a Mortgage, & Valuable Post-Close Information.

Racheli Refael Smilovits

Racheli Refael Smilovits

Generating Quality Leads Without....

The captain painter with Augusto

Home inspections with Michael Gaurnier

SERVICE

As a Fairway Loan Originator I have a vested interest in helping you buy a home. I will help you find the best loan at the best rate possible and take

excellent care of you.

After all, you are entrusting me to assist you in one of the largest financial transactions of your life and I respect and appreciate your confidence me.

INTEGRITY

You will find me and my processing team to be honest and respectful of your time, and willing to help in any way possible.

I will take the time to unearth all of the information. I will prove to the banks that credit scores are more than numbers - they are the sum of the challenges we all face.

ACCURACY

My team promises to close your loan on time with complete accuracy and answer any questions that you may have. The best, most accurate operations team in the business supports each loan officer, including me.

We will ensure that all documents are complete and turn in your paperwork early so that there is no last-minute pressure on you.

RELIABILITY

My Teams reputation in the mortgage industry for being reliable is unmatched.

Once you finance a loan through Fairway, I am confident that you will be a customer for life.

THE TYPES OF FAIRWAY LOANS

Let's Crush this Homeownership Thing.

*Appraised property value may affect loan amount.

**The cash from equity is usually tax free. This information does not constitute tax advice or financial planning advice. Please consult a tax advisor for tax advice and a financial planner regarding enhancements to retirement plans. Fairway is not affiliated with any government agencies. These materials are not from HUD or FHA and were not approved by HUD or a government agency. Reverse mortgage borrowers are required to obtain an eligibility certificate by receiving counseling sessions with a HUD-approved agency. Must be at least 62 years old. Loan proceeds are not considered income and will not affect Social Security or Medicare benefits. Your monthly reverse mortgage advances may affect your eligibility for some other programs. Consult a local program office or your attorney to determine how, or if, monthly reverse mortgage payments might affect your specific situation. At the conclusion of the term of the reverse mortgage loan contract, some or all of the equity in the property that is the subject of the reverse mortgage no longer belongs to you and you may need to sell or transfer the property to repay the proceeds of the reverse mortgage with interest from your assets. We will charge an origination fee, a mortgage insurance premium, closing costs or servicing fees for the reverse mortgage, all or any of which we will add to the balance of the reverse mortgage loan. The balance of the reverse mortgage loan grows over time and interest will be charged on the outstanding loan balance. You retain title to the property that is the subject of the reverse mortgage until you sell or transfer the property and you are therefore responsible for paying property taxes, insurance, and maintenance. Failing to pay these amounts may cause the reverse mortgage loan to become due immediately. Interest on reverse mortgage is not deductible to your income tax return until you repay all or part of the reverse mortgage loan.